April 21 Newsletter

Business Update

Accounting Update

10 things you didn’t know an accountant could do

When asked “What does an accountant do?” Many people answer with accounts, tax or compliance work. While that’s true, what many don’t know, is that the good ones do so much more. The best accountants will become a part of your team; they will give you strategic advice to save money and boost revenue, they will help you work more efficiently, and they will not only help you plan for your future, but they will help you get there.

1. Launch a start-up – You need to know that your idea will make money and may potentially need to convince investors of the same thing. An accountant can do that for you plus work out your start-up and operating costs and create credible revenue forecasts.

2. Manage your cash flow – Getting a stable and consistent cash flow is every business owner’s dream. An accountant can make sure that you always have the money there to pay staff and suppliers, as well as cash reserves in case of an emergency.

3. Help make you more tax-efficient – Everyone knows that an accountant can help you complete and submit your returns at the end of the tax year. What many don’t know is that they can also help you to lower your tax ethically as well as helping you deal with old tax debts.

4. Manage your debt – What loan should you choose? Should you use spare cash to pay back loans or reinvest in the business? An accountant can help you develop a specific strategy to manage debt in a way that is best for your business.

5. Chase unpaid invoices – An accountant takes the ‘chasing money’ headache away from you, when a payment is due or overdue, Xero will send out automatic reminders to your clients until they pay.

6.

Improve your business strategy

– Your accountant can help you figure out where you want to go and what’s important. They will work with you to set realistic personal, professional, and financial goals, and then they will measure your progress to help you achieve them.

7.

Budgeting and forecasting

– Working off a vague set of numbers can result in irreparable damage to a business. With an accountant, you can work to an exact budget where you know exactly what is coming in and going out, and how much money you have to reinvest, and all in real-time. As well as having the figures at your fingertips, you will also know your figures that you’re aiming for and how long you could last in a crisis.

8.

Help your business run more efficiently

– In addition to accounting software, accountants can also help you unlock the power of other applications so that you can start working smarter, not harder. They can help you increase productivity with your invoicing, payroll, customer relationship management, staff scheduling and time-recording etc, and integrate all these tools together to create an effortless workflow.

9.

Set up your cloud accounting software

– A growing number of accountants aren’t stuffy number crunchers who speak a different language, they are tech-savvy and future-driven. Using the best tools out there, good accountants can help you automate your business’s accounting so that you’re always on top of your finances wherever you are. As well as implementing this software in your business, they can also train you to use it confidently and advise on the best software for your business.

10.

Listen and support you

–A good accountant will become an essential part of your team. They will be your financial advisor for all aspects of your life and will be there to listen and support you whenever you need them (not just appear in your life at the end of the tax year). They provide impartial advice and act as a sounding board for new ideas and strategies.

Employing members of your family

This is a popular topic that we get asked about. Here are the main points that you should consider:

Age is important

The youngest age a child can work part-time is 13, except children involved in areas like television, theatre and modelling: these children will need a performance licence. Once a child has reached school leaving age they can work up to 40 hours per week, but it’s important to note that the devolved nations of the UK have slightly different interpretations of school leaving age, so where you live in the UK is important.

Paying minor children in a family business

For school-aged children (ie children under 16), they are not entitled to the National Minimum Wage (NMW), so what you pay them is a mixture of common sense and the wholly and exclusively rule (a fair wage for the job that they are doing).

How much National Insurance contributions (NICs) should I pay?

Children under 16 do not pay NICs.

Reporting to HMRC

If you’re a registered employer, you’ll need to record and report their pay as part of your RTI duties if they earn more than £120 a week.

What about a spouse/civil partner – what are the rules?

Effectively they say that you can’t overpay a spouse or civil partner. You have to pay the going rate and to do this you have to look at comparators in the marketplace, although you can flex the rate if the spouse or civil partner is working weekend and evenings, which is something that an average third party employee would be much less willing to do, without an overtime rate being paid.

Is it a good idea to make a spouse or civil partner a shareholder director in the family business?

In the right circumstances, it can be a very good idea. The irony of the British tax system is that it is easier to justify a shareholding than it is a salary.

Pension payments from a family company into a pension pot for a spouse and children

It is quite normal for a family company to make pension contributions on behalf of a spouse and employed adult children. You just need to look at the value of the overall package to see that it is fair for the tasks completed.

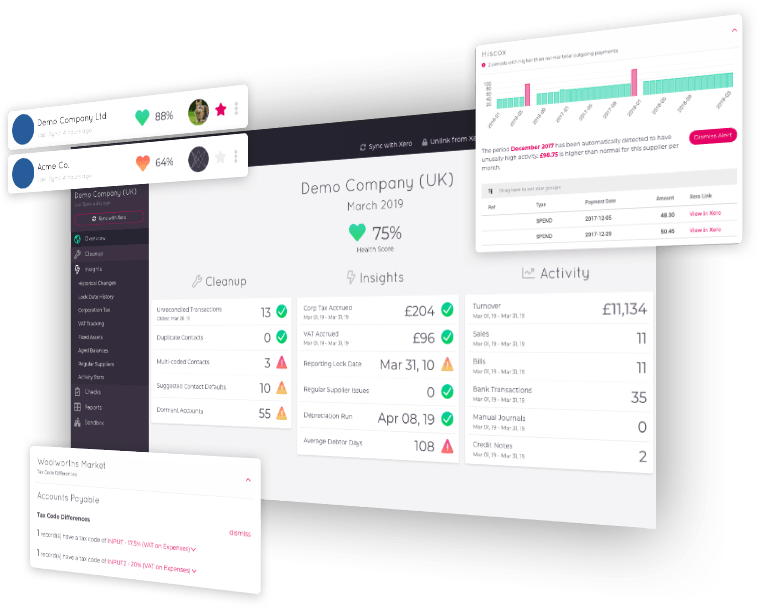

App of the month

As we are fin ding business owners are wanting more real-time information (quarterly isn't enough) and moving across to a more proactive accountant we are finding that a lot of the key areas of Xero haven't been set up properly .

The question: Can you tell me what we need to do to improve our procedures?

The research: Dext will run a quick health check on all of the data in Xero

The solution: It will then produce a report for us to start working on in the background to make sure efficiencies are set up. It will also suggest any transactions that need a little more attention.

Team News

As we come out of lockdown, we are looking forward to returning to our office and seeing people in person (rather than over a video call)! We would like to wish you a very Happy Easter and we hope we will see you soon for a coffee and a catch up.

But in the meantime, if there is anything you would like to discuss, then please give us a call on 01908 751 972.

Keep safe and well,

Katherine, David and Kasia