May 21 Newsletter

Business Update

How to have more confidence as a leader

Self-confidence is something that can be learnt.

It’s true, that some of us are born with more confidence than others. I’m thinking of that annoying person we all know that seems to talk the talk and project so much self confidence that they naturally steal the limelight… but this is not something that some of us have and some of us don’t.

If you want to have more gravitas and confidence, especially at work, start by implementing these 5 steps (and keep practicing them until they become natural to you!).

1. Stand up straight with your shoulders down

Your posture and body language is absolutely crucial when it comes to the presence that you are projecting. For example, if your voice is strong but your shoulders are hunched and you’re looking down, people will perceive you to be closed off and shy.

If you want to appear more confident and have a greater presence, open up your chest, stand tall and make direct eye contact. So much of what people call gravitas is actually just their reaction to the other person’s body language. Take stock of yours and make sure you are projecting outward confidence.

2. Use direct language

You need to reinforce your body language with how you talk, so make sure that you’re not using passive language. Saying things like “I just think that…”, “Maybe if I…” or “Am I making sense?” will undermine your authority, credibility and confidence. If you want more gravitas, you need to think about the language you use. Replace passive phrases with active and direct phrases such as “From my point of view… The truth is… What is your stand on…”

3. Overcome your self-limiting beliefs

Identify any self-limiting beliefs that are reducing your gravitas. This could be always saying yes to requests, letting others influence your decisions instead of you making the final call, and/or letting others speak over you.

Behaviours such as this often come from self-limiting beliefs about yourself such as not feeling good enough or like an ‘imposter’ in your role. Identify these so that you can start making impactful changes.

4. Pace your words and emphasise key points

When presenting or in meetings, think about the great orators of our time (e.g. Barack Obama, Winston Churchill etc). They make short, sharp points; they take their time over their words and say them with conviction, pausing for impact, and they put emphasis on certain keywords and phrases that they want you to remember.

If you want to have more gravitas, where your team hangs on to your every word, make sure you do these three things when conversing and presenting.

5. Always prepare before key meetings or conversations

Obama and Churchill didn’t wing their speeches, they prepared for them. Not only were their speeches carefully crafted and each word chosen carefully, but they also practised delivering the speech.

Most of us prefer to have time to think before answering a question, rather than having to think on our feet, so give yourself this time. Prepare before key meetings or conversations and it will be far easier to converse and answer with confidence.

Accounting Update

Super Allowances - what are they and how do they work?

In the recent spring budget, the chancellor introduced a new financial instrument, Super Allowances.

What is it?

The new allowance is intended to help companies to invest in new assets. The allowance is available for a two-year period ahead of the planned increase in corporation tax in 2023, when the headline rate will rise from 19% to 25%. The government hopes that by encouraging companies to invest during the next two years, this will kickstart the economic recovery. These new allowances are in addition to the existing Annual Investment Allowance (AIA) which, until 31 December 2021, permits 100% relief for up to £1m of expenditure on qualifying plant and machinery assets. The Super Deduction effectively reduces the capital cost of a qualifying asset by 25%, so it is definitely worth looking at if you are thinking of buying new equipment.

How does it work?

The new allowances are only available to companies buying qualifying equipment between 1 April 2021 and 31 March 2023.

Exclusions are;

- sole traders, partnerships and LLPs

- Expenditure incurred under a contract entered into before 3 March 2021

- Second-hand assets

- landlords

There are two types of new allowances:

The Super Deduction - a new 130% first year allowance for expenditure on assets such as machinery, furniture, fittings, computers, etc.

Enhanced Special Rate - a new 50% first year allowance for special rate assets including integral features in buildings such as electrical, water and heating systems.

But, beware:

- Disposal proceeds for the sales of assets where Super Allowances have been claimed will be taxed in full as a balancing charge

- Any sales of a Super Deduction asset before 31 March 2023 will be subject to an enhanced disposal value calculated by a multiple of 1.3. A tapered multiple is then applied to disposals in accounting periods which straddle 1 April 2023

- Any sale of an Enhanced Special Rate asset will trigger a balancing charge equal to 50% of the disposal value.

So, overall good news for companies that were already planning to buy new equipment during the next two years, but think carefully about disposing of them before 31 March 2023.

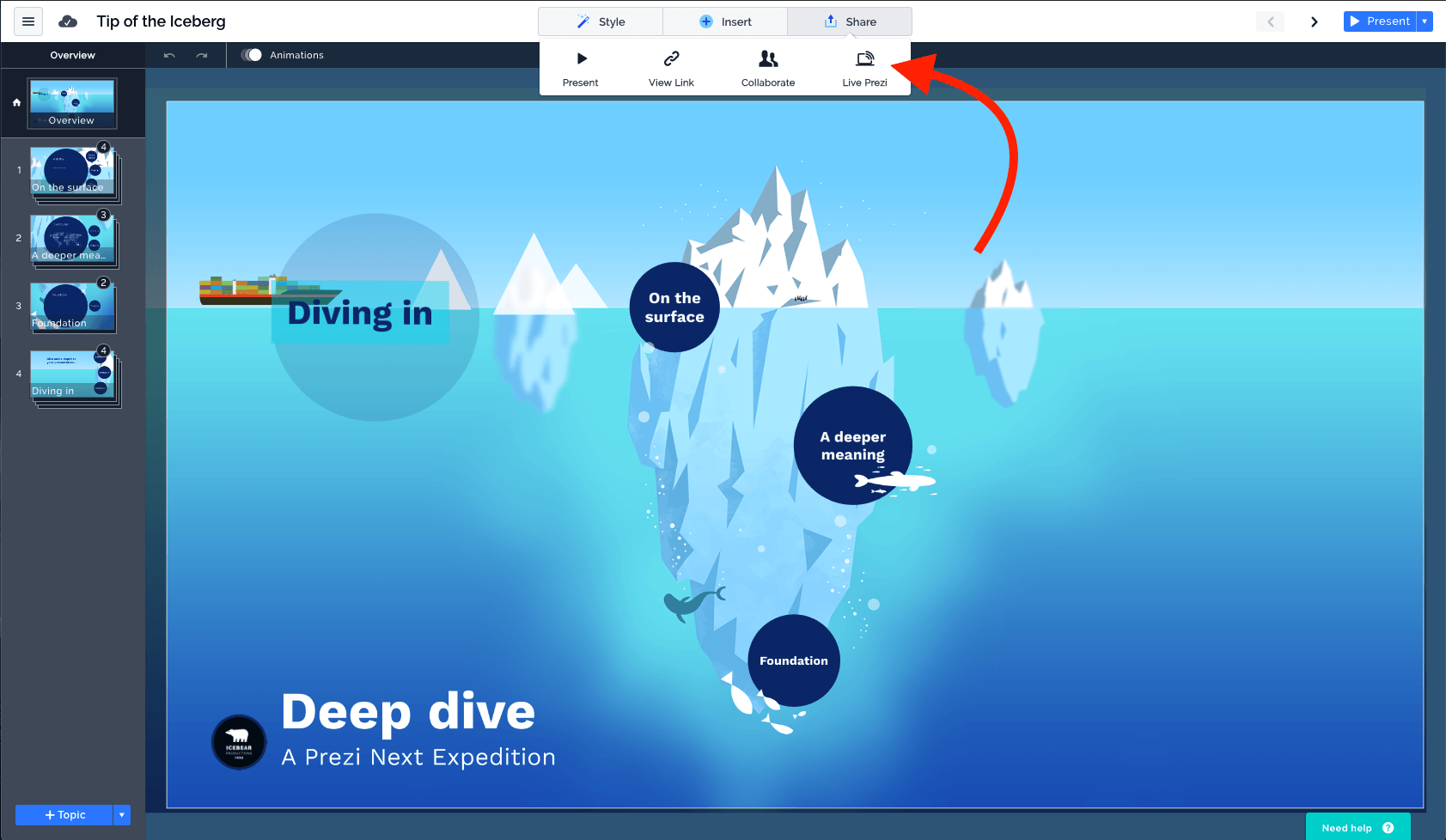

App of the month

This is a great bit of software that can make presentations look slick and stand out from the crowd

Although this isn't something we are currently using internally we have seen this used in some of our international accountancy groups.

The presentation is clean and crisp

Its Interactive

You can embed videos

You can drill down on each subject to give more details.

Team News

We have been so pleased to return to a bit of normality and reopen our office, and more importantly buy a new coffee machine! Kasia has sadly left our team to start a new adventure back in industry but we are very excited to welcome Ben. Ben has previously worked in another accountancy practice and is keen to help us automate our processes further. We tend to be in the office most days now, so please feel free to drop in and see us.

And, of course if there is anything you would like to discuss we are also available for video calls / phone calls (01908 751 972).

Keep safe and well,

Katherine, David and Ben